does workers comp deduct taxes

This deduction allows your workers compensation benefits to be deducted from your income. Yes workers comp payments and benefits that employers pay to their employees are deductible business expenses.

Workers Comp Overpayment The Bottom Line Group

The employee will report the workers compensation claim on their 2021 income tax and benefits return and will take the corresponding deduction.

. This ensures that you are not taxed on both amounts. How Does Workers Comp Affect a Tax Return. Any workers compensation benefit that you can receive is exempt from taxes.

The IRS does not allow you to deduct workers comp benefits on your tax return. While workers compensation payments are considered income theyre not subject to an income tax and you dont need to report them on your IRS forms. Workers compensation benefits are payable to individuals who have suffered a work-related injury or illness.

Up to 25 cash back 7031 Koll Center Pkwy Pleasanton CA 94566. Are taxes normally taken out of workers compensation payments. Employers pay into state workers compensation funds or self-insurance.

Youll want to make sure to keep track of your premium payments and include them at tax time. As an employer you are responsible for the total cost of workers compensation insurance and can deduct the premiums you pay from your. In the eyes of the IRS workers compensation insurance is typically tax-deductible.

WorkCover should send you a statement of payments like a PAYG summary that you can use. Benefits Exempted From Tax Payments. The short answer to this question is no taxes are not normally taken out of workers compensation.

When your employees are receiving workers compensation benefits they may wonder if theyll have to pay taxes on them. Then benefits are paid to. Moreover an experienced workers compensation attorney may be able to structure your workers comp settlement in a way that minimizes the offset and reduces your taxable income.

If your total monthly workers compensation benefits or your benefits plus other income are more than the maximum SSI monthly payment amount your SSI application. Can I deduct from my taxes the workers compensation deductions I am forced to pay as an IC for the company I work for. IRS Publication 525 pg.

Workers compensation programs are administered by states. The quick answer is that generally workers compensation benefits. Your workers compensation benefits will be subtracted from your taxable income.

But if you receive a lump-sum payout or a settlement from a common law claim. Will I Receive a 1099 or W-2 for Workers Compensation. Here we go.

Just like its good practice to protect your employees and your business with workers compensation insurance. Report the amount shown in box 14 of your T4 slips on line 10100 of your Income Tax and. Business owners are able to deduct the costs of required.

Is workers comp tax deductible. You should not receive a 1099 form. As long as you are receiving your benefits from workers.

The amount of the Workers Compensation is never. You will not amend the 2020.

W2 To Paystub Reconciliation Wyoming State Auditor S Office

Tax Deductions List Of Tax Deductions Bankrate Com

Workers Compensation And Taxes Phalenlawfirm Com Ks And Molaw Office Of Will Phalen

Workers Compensation And Taxes James Scott Farrin

2022 Federal State Payroll Tax Rates For Employers

17 Rental Property Tax Deductions Landlords May Claim Each Year Rentals Com Company Blog

19 Self Employment 1099 Tax Deductions Bench Accounting

Simple Business Deductions Excel Pdf Tax Deductions List Etsy

Workers Compensation Settlements Rosenfeld Injury Lawyers

Pay As You Go Workers Comp Insurance Adp

25 Small Business Tax Deductions You Should Know About Hourly Inc

Income Definitions For Marketplace And Medicaid Coverage Beyond The Basics

How To Calculate Payroll Taxes Futa Sui And More Surepayroll

What To Know About Maryland Workers Comp Claims The Poole Law Group

Solved Bramble Corp S Gross Payroll For April Is 45 300 Chegg Com

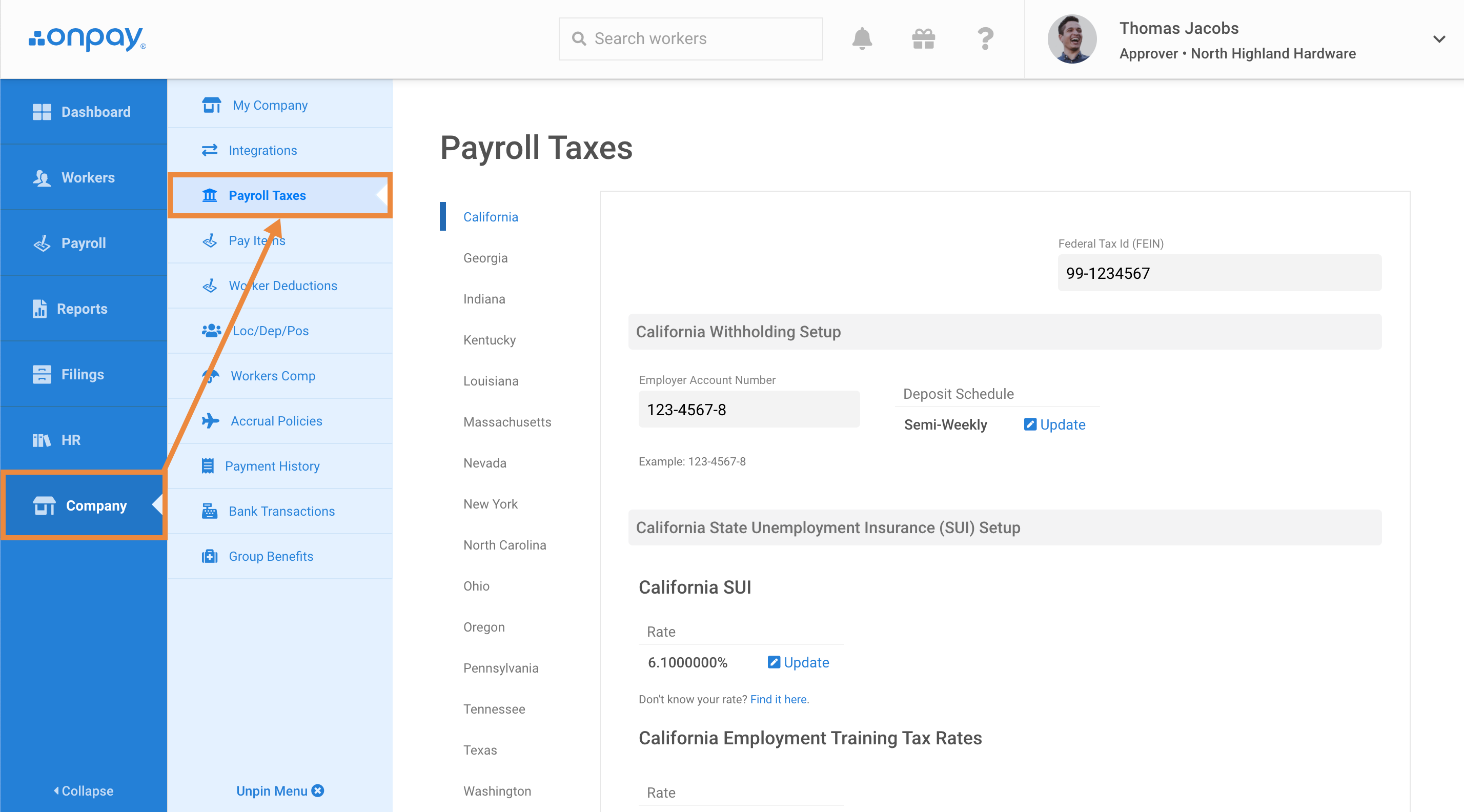

Add Or Update State Payroll Tax Information Help Center Home

Simple Business Deductions Excel Pdf Tax Deductions List Etsy